Boost your savings

Boost your savings:

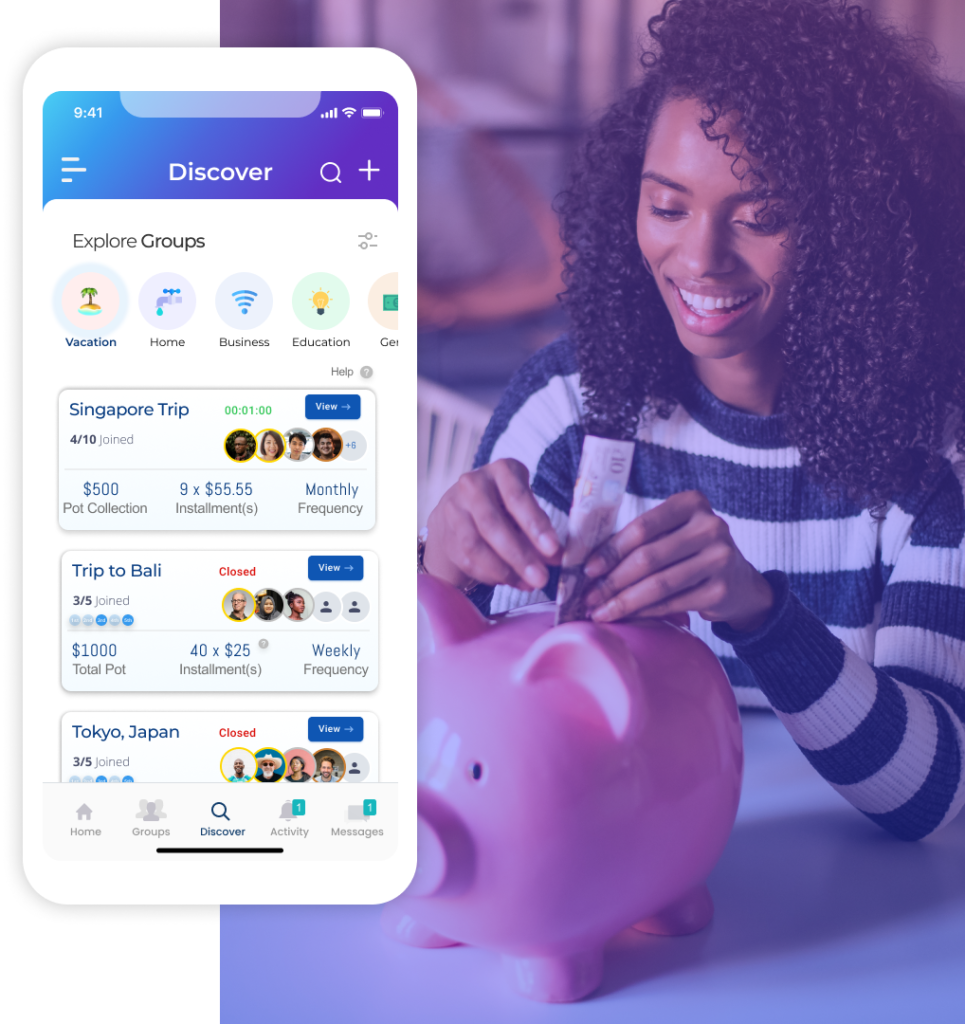

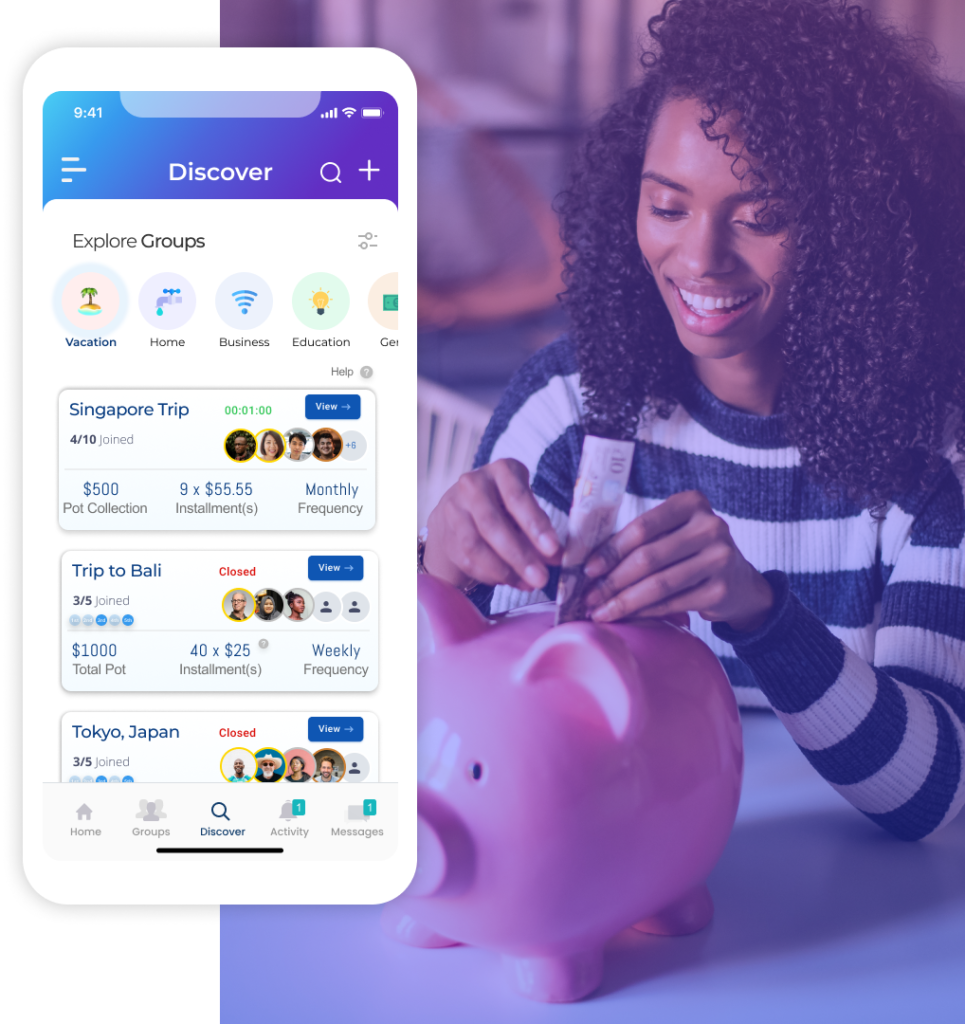

Join the community of users who are revolutionizing their financial habits — Download in under 2 minutes

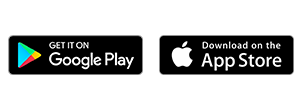

- Flexible Saving Plans

- Instant Access

- Automated Transactions

Join the community of users who are revolutionizing their financial habits — Download in under 2 minutes

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

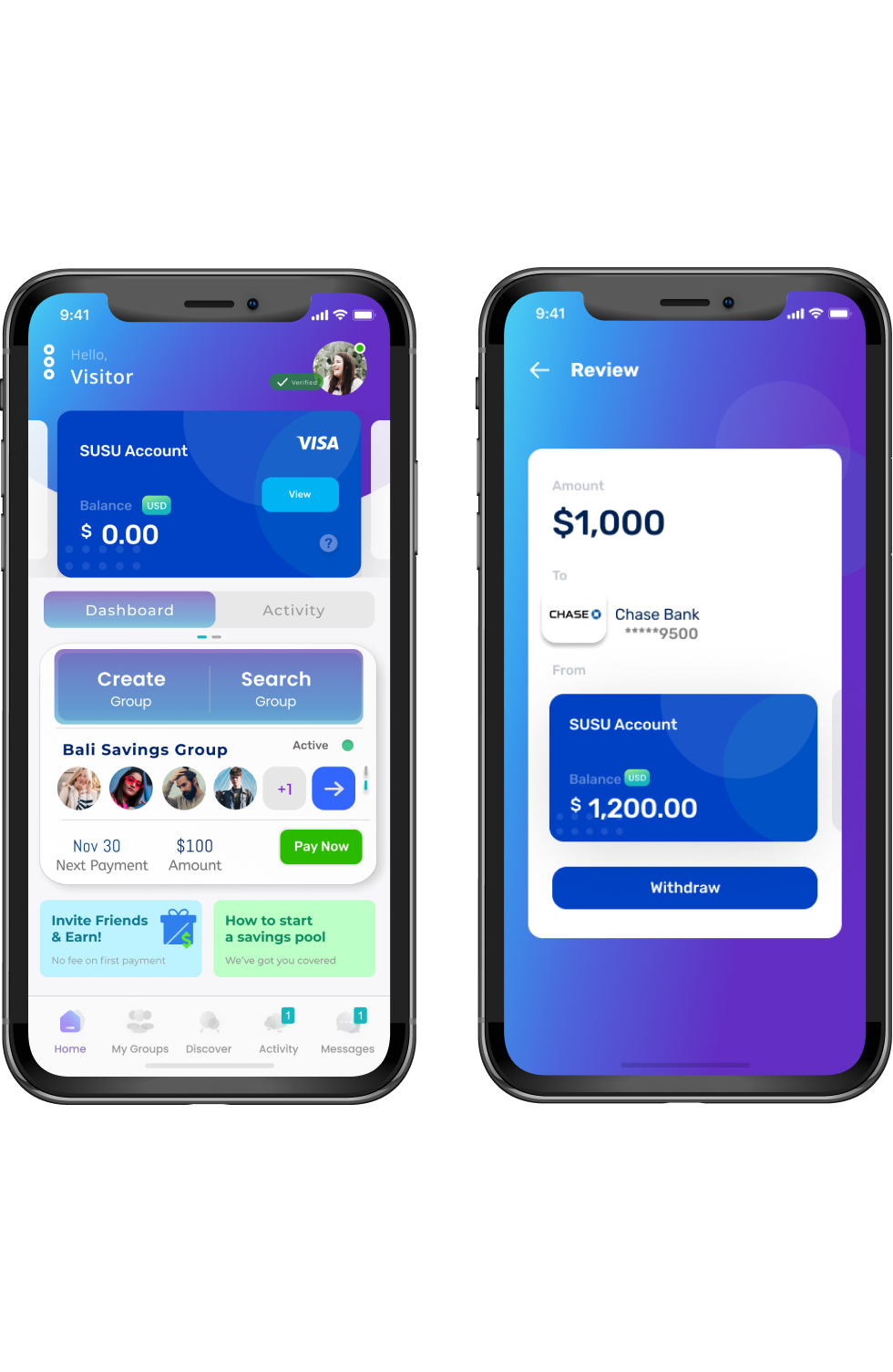

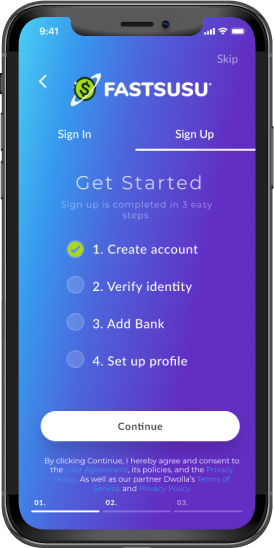

Create an account using our secure and encrypted registration form. You will need to be verified in order to make and receive payments. A valid U.S bank account will be required upon registry.

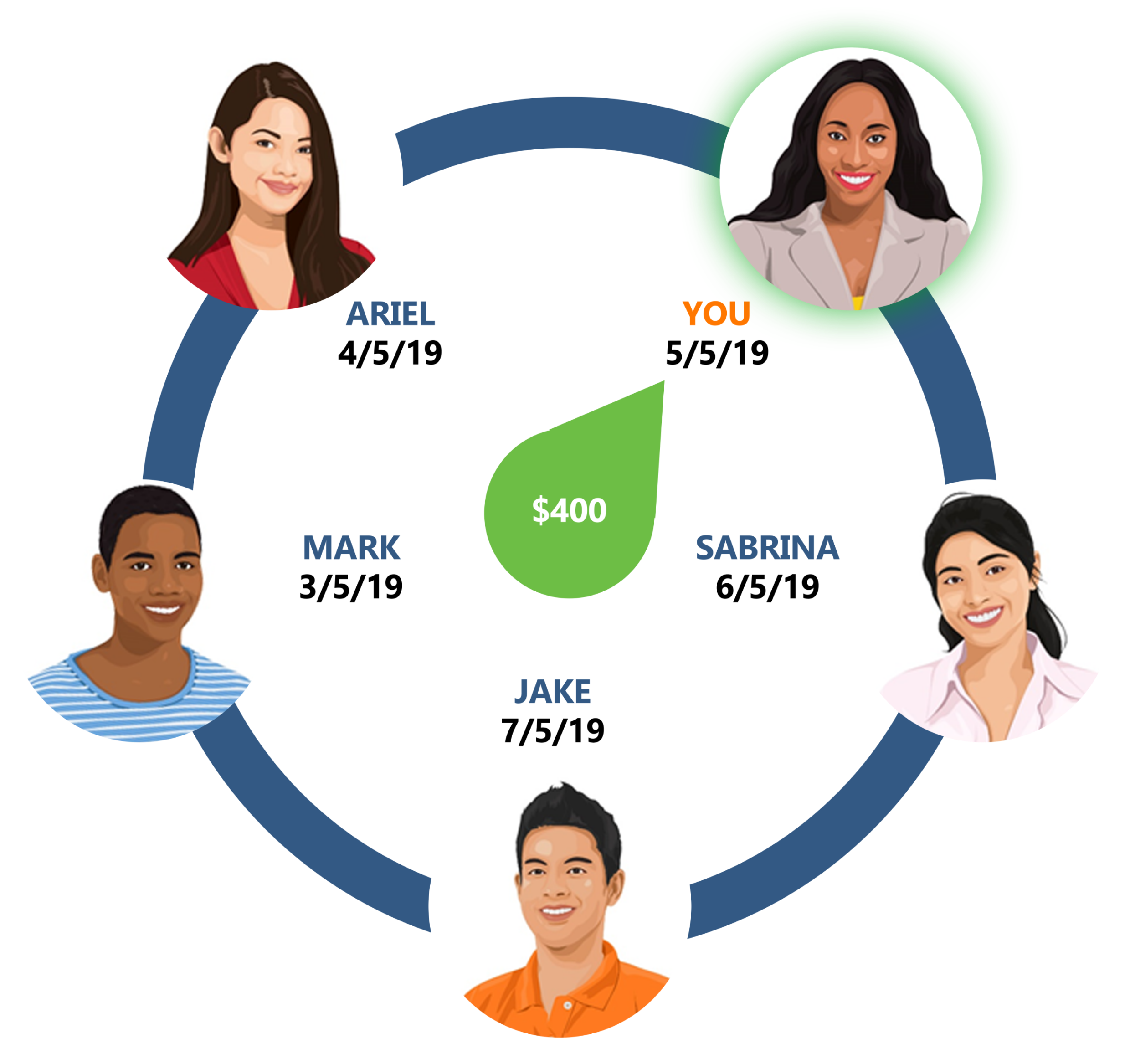

Saving with others can help you reach your savings goals faster. Find a group online or invite a group of friends to save with you. Commit to rotating funds on a bi-weekly or monthly basis. Our system tracks and notifies you of upcoming payments.

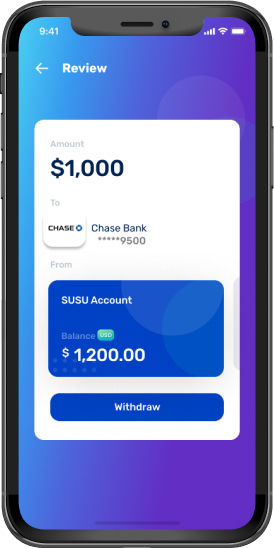

When it's your turn to receive funds, easily deposit the collection into your linked bank account. Transactions are fast and instant, as we've partnered with trusted and reliable payment providers.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

We implement the latest encryption methods, including TLS for secure connections and AES-256 for data protection, ensuring your personal and financial information is always encrypted and secure

Your financial data is managed with rigorous privacy standards, providing a secure link between your bank account and our services without compromising your sensitive information.

Rotational savings, often known as a “Susu” or “ROSCA” (Rotating Savings and Credit Association), is a traditional form of collective savings where a group of individuals contribute to a common fund on a regular basis (weekly, monthly), and the total amount collected is given to one member at a time. This rotation continues until all members have received their share, helping participants save money or fund larger purchases without incurring debt.

Fastsusu offers a unique and innovative platform designed to enhance your financial well-being through the power of community savings. By participating in rotational savings groups, you gain access to a disciplined saving routine, potentially earning you a lump sum of money faster than traditional savings methods. Fastsusu also provides a secure and transparent environment for your transactions, equipped with state-of-the-art security measures to protect your personal and financial information. Beyond savings, Fastsusu fosters a community of like-minded individuals, offering you the opportunity to learn from others, share financial insights, and grow your network. Whether you’re looking to save for a specific goal, invest in your future, or need access to funds without the burden of high-interest loans, Fastsusu empowers you with the tools and community support to achieve your financial objectives.

Exiting a Rotational Savings group early is highly discouraged as it results in a loss of all previous contributions, underscoring the importance of commitment. Members are encouraged to carefully consider their ability to participate for the full cycle before joining. It’s crucial to ensure you are saving with people you trust. FastSusu facilitates this process by verifying that all members have the necessary funds to begin saving, aiming to build a trustworthy community where everyone benefits by staying the course